A First Time Guide to Buying a House

Kyle Gill, Software Engineer, Particl

My wife and I wanted to buy a house shortly after we got married in 2021. We told ourselves, “the market is too crazy now” and sat on the sideline until about a month ago when we said “the market is too crazy now” and decided to go buy a house anyway.

The Kyle of yester-year knew about this much 🤏 about buying a home:

- there’s a thing called a pre-approval

- high interest rates are bad

- real estate agents get 6% of the sale price

- and he thought escrow was a style of deli sandwich

I was the village idiot of home buying whenever friends or family were talking about “this crazy COVID housing market”.

I looked up a lot of stuff and talked to a lot of different people, most of them tried to sell me something and I only bought some of those things. I wanted to write up every stupid little detail I could remember that I felt was important as I went through the process for other first time home buyers like me, and perhaps for a future me when the time comes to buy a second home and I’ve forgotten everything.

I was concerned about making the biggest purchase of my life and being played a fool. To make myself an educated buyer, I relied on a lot of ChatGPT and a lot of questions. Here’s my attempt to distill what I learned in one place.

Note: some of this information is only relevant to Utah home buyers, but many other principles and applications remain relevant.

The TL:DR of it all

When it comes to buying a house there are a couple main steps I’d categorize things into:

- Budgeting and saving for a house

- Finding a house

- Paying for a house

- Due diligence

- Moving in

To set some context, here is a big list of definitions of terms put in my own words. Feel free to skip or scan over this, or refer back to it as you read through:

| Term | Definition |

|---|---|

| Mortgage | A loan on a house |

| Lender | A person or institution that loans you money |

| Principal | The amount of money you owe on the house |

| Interest | The amount of money you pay to the lender for the privilege of borrowing money |

| Down payment | The amount of money you pay up front to reduce the amount of money you need to borrow |

| Closing | The day you sign the paperwork and get the keys to the house |

| Closing costs | The fees associated with closing on a house |

| Pre-qualification | A tentative informal letter from a lender that says they are willing to loan you money, based on numbers you tell them |

| Pre-approval | A letter from a lender that says they are willing to loan you money, based on numbers you prove to them via documents and bank statements |

| Earnest money | A deposit you make to show the seller you’re serious about buying a house |

| Escrow | A third party that holds onto money until the sale of a house is complete |

| Appraisal | A third party that determines the value of a house |

| Inspection | A third party that determines the condition of a house |

| Title | A third party that determines the legal ownership of a house |

| HOA | Home Owners Association, a group of people that make rules about what you can and can’t do with your house |

| PMI | Private Mortgage Insurance, an insurance policy that protects the lender in case you default on your loan |

| Financing | Getting a loan to pay off your house |

| Refinancing | Getting a new loan to pay off your old loan |

| Amortization schedule | A schedule that shows how much of your monthly payment goes to interest and how much goes to principal |

| Realtor | A person that helps you buy or sell a house |

| Builder | A person that builds a house |

| MLS | Multiple Listing Service, a database of houses for sale only accessible to realtors |

To start with perhaps the most controversial thing in the post COVID era: finances.

1. Budgeting and saving for a house

Before anything else, it’s wise to get oriented on what you can afford.

Because virtually no one has the cash on hand to buy a house outright, you’re almost certainly going to need to get a loan or a rich relative. I didn’t have a rich relative, so I figured I needed to get a loan.

Some common advice I saw to live within your means suggested that your eventual monthly payment should be somewhere in the range of 25-30% of your monthly income. That means if you make $10,000 a month, you should be looking for a scenario where you could expect to pay about $2,500-$3,000 a month.

However, some unexpected advice from a financial advisor I talked to was that a loan on a house lasts 30 years, and during that time, your income will likely go up. So, if you’re making $10,000 a month now, you might be making $15,000 a month in 10 years. Looking through that lens, you may be able to bat a little higher than your league.

In addition, to qualify for a loan, you can get better terms if the following things are you have a stable income, good credit, and save some money for a down payment.

If a house costs $500,000, and you make a down payment of $100,000, you’ll need to get a loan for $400,000. From the day you close on the house (more on that later), you’ll own $100,000 of the house and the bank will own the other $400,000. Over time, that’s what you’re paying off.

In summary:

- save up money to prepare to make a sizeable down payment

- pay off your debts and keep your credit score up

- stable employment will in the process to eventually get a loan

- income goes up over time so you might be able to afford a little more than you think

2. Finding a house

When you feel like you’ve got ample funds and a stable financial situation, it’s time to start looking for a house. There are two main ways to do this: with a realtor or through a builder.

- With a realtor: who can help you find houses to tour in the area and connect with the realtor of normal plain Jane citizens trying to sell their own home

- Through a builder: who can build a brand new house for you, or sell you one they’ve already built which skips some steps

- (bonus) For sale by owner: where you find a house that’s not listed on the MLS and you work directly with the seller

With a realtor

- you can get access to homes that might not be on the market yet because realtors have access to the MLS (sites like Zillow and Realtor.com try to scrape info off the MLS too though)

- they’ll take 3% of the gross sale price on the house you buy (not the net, so if you buy a house for $500,000, they’ll take $15,000), in a weird sort of way, this incentivizes them to encourage you to buy a more expensive house, not necessarily help you get the best deal

- they can help you negotiate with the seller in ways you might not be aware of, like asking for the seller to pay for closing costs, or asking for the seller to pay for repairs

Through a builder

- you’ll have to buy a new house, which means no one else will have lived in it

- you could have to wait for a house to be built, which could take a long time, and during that time the builder is probably going to do what’s best for them financially and not you (time is against you)

- (sometimes) you can customize some things about the house to get what you want, in our case the builders we talked to weren’t willing to do this since they were trying to build houses as fast as possible to meet Utah’s demand

- everything will have to be built to city code, so you won’t have to worry about old house problems and as much stuff breaking

For sale by owner

- I didn’t really look into this cuz it seemed hard, but is an option if you are an educated buyer and know what you’re doing and don’t want to fork over 6% to realtors

Stuff like Homie in Utah is pretty close to this. They’ll help you with the paperwork and things, but you’ll have to do a lot of the legwork yourself.

Used vs New

New homes through a builder sounded nice to us, since we figured it’d probaby mean less stuff like a furnace going out soon. There are some pros to buying a used house like the previous owner having already put in many thousands of dollars of ugrades like cabinets, curtains, and especially landscaping. A new house could be part of an HOA that requires you to put in a lawn yourself.

Where to find homes

If you go through a realtor they’ll probably find and send you homes. Either way you should probably use Zillow, Realtor.com, or Redfin as well. When you find a used home you can reach out to the seller through those sites to tour and visit them, or a realtor can help you with it.

Walking through houses is kind of like a sniff test of “do we like this enough to buy it”? If you really do like it, that’s when you advance into the stage of making an offer and actually paying for it.

Note: At some point during this step, you’ll also need to find a Mortgage Lender, this could be a bank, a mortgage broker (who sends your info a lot of places to find the best rates), or some other institution like a credit union. This is where you get pre-qualified and eventually pre-approved for a loan, which basically means the lender says “we’ll loan you money if you want it”. This will tell you a very high bar for what you could afford, but you should probably still not exceded the 25-30% rule from the previous section.

In summary:

- you can find a house through a realtor, a builder, or for sale by owner

- you can find houses on Zillow, Realtor.com, or Redfin yourself as well

- you’ll need to find a mortgage lender to get pre-qualified and pre-approved for a loan sometime around this step too

3. Paying for a house

When it finally comes time to pay for a house things get hairy. You can pay with cash or get a loan, since we paid with a loan that’s what I’m going into.

Financing and Refinancing

The term refinancing is thrown around a lot in home buying contexts. Financing and refinancing are basically synonymous, it’s when you get a loan to pay for a house. Refinancing is just when you get a new loan to pay off the first one, in an attempt to get better terms on your loan.

Different types of loans

There are 3 main types of mortgage loans you can get: conventional, FHA, and VA. FHA loans are to help those with less income be able to get a loan, and VA loans are for veterans. Conventional loans tend to be the “default”, and what we got. The typical loan term is 30 years, meaning you’ll be paying off the loan for 30 years.

There are also some other fancy types of loans like Balloon loans, which are 7-8 years, and you then are forced to refinance. Since most people don’t stay in their house more than 7 to 8 years, might be worth looking into these in some cases, but you risk having to refinance at a worse rate.

Interest rates and Amortization schedules

Interest rates are the amount of money you pay to the lender for the privilege of borrowing money. The interest rate you get is based on a lot of factors, but the main one is your credit score. The higher your credit score, the lower your interest rate.

People harp and harp about interest rates because they affect how much you pay monthly, and how much you pay in total for your house a lot. Your friend down the road that got a 2% interest rate is bragging about it all the time because well, they got a screaming deal and they probably should brag about it.

Here’s a couple examples for the exact same $500k house. Assuming a 30 year loan, and a 20% down payment, here’s how much you’d pay in total for the house at different interest rates (with numbers rounded):

| Interest rate | Monthly payment | Total money paid |

|---|---|---|

| 2% | $1,500 | $533,000 |

| 4% | $1,900 | $689,000 |

| 6% | $2,400 | $863,000 |

| 8% | $2,900 | $1,056,000 |

Note: these monthly payments here are just the mortgage payment, not including other costs like insurance, PMI, HOA, etc.

Look back up at those numbers again and let that sink in. The difference between a 2% interest rate (virtually unheard of) and an 8% interest rate is the difference in paying half a million extra dollars, FOR THE SAME HOUSE.

This is one of the most key things to understand about buying a house. The interest rate you get is a big deal.

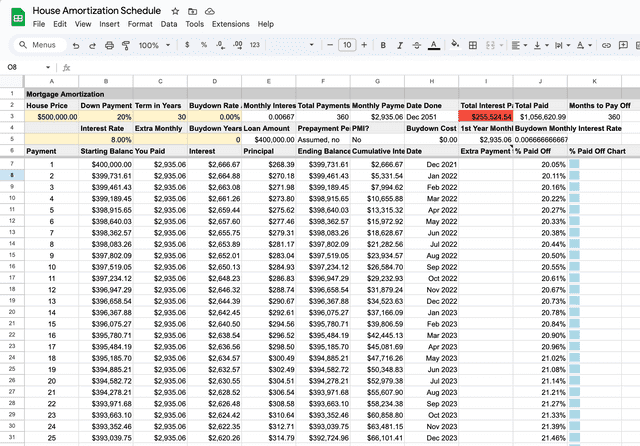

You can play out different scenarios if you model payments in an amortization schedule. I found a lot of really crappy, overwhelming ones online, and realized to really understand this stuff I should probably just calculate it myself. So naturally I made a spreadsheet that you too can be overwhelmed by and make your own copy.

Of all the things I did and learned I think learning about these financial scenarios affects the future me the most. Being able to see that if me and my wife pay an extra $300 a month for just the first year, we could save $18,000 in interest over the life of the loan! That’s a lot of money! Definitely, definitely, play around with some tool like this to get an idea of what you’d be paying monthly and where you could save.

The Subtle Benefits of Interest and Principal

One caveat to the above section, is that money paid towards interest can reduce your taxable income. This isn’t helpful to everyone if the standard tax deduction already covers your income (and you don’t itemize your deductions on your taxes).

In that sense, interest expense isn’t all bad.

There’s also the obvious pro that the money that pays down your principal comes back to you when you sell the house.

The Surprisingly Bad Investment of Real Estate

There are plenty of cons to paying for a house and interest though. Everyone who tells you as a renter that you are “just burning money” and “paying for someone else’s mortgage” exclude the fact that you’re rent is more likely only paying down a teeny tiny fraction of your landlord’s principal. 🤷

Under a scrutinizing eye, real estate isn’t always the most amazing investment. TikTok real estate bros will shout “cash flows” from the rooftops, but the reality is that real estate just doesn’t grow as fast as the S&P 500.

You can check out online calculators like this one to see how much money you’d have if you invested in the S&P 500 vs. real estate.

The housing market is weird and volatile these days like the stock market, so gaming or timing it is probably a fool’s errand. If you’re looking for a good investment, real estate is a fine one to help diversify, but it’s not everything others make it seem like.

Earnest money

When you’re serious about a house and you make an offer, you’ll need to put down some earnest money. This is a deposit you make to show the seller you’re serious about buying a house. If you back out of the deal, you’ll lose this money. If you go through with the deal, this money will go towards your down payment. This could range from $1,000 to $10,000 depending on the house and the market.

If you are working with a builder your earnest money will probably just mean you will get the house unless something goes wrong getting a loan. If you’re working with a realtor, the person selling the house needs to accept the offer you’ve made. If they don’t, you’ll get the earnest money back.

Getting a loan

At this point you’ll probably have been pre-approved, and a lender will have given you a letter saying they’ll loan you money. You’ll need to get a loan for the amount of money you need to pay for the house, minus the down payment you’re making.

The lender is going to ask you about a billion questions and require proof you make what you do and you aren’t sending kickback money to a gang of pirates in Somalia. They’ll want bank statements, pay stubs, identification, you name it.

Those documents go to an underwriter, who will look at them and decide if you’re a good candidate for a loan. This process as I understand it has only gotten harder since the 2008 financial crisis when too many people got loans they couldn’t afford.

Negotation

There are a couple ways you can negotiate with the seller when making an offer. Offering to sign sooner, making an all cash offer, or offering a pagan sacrafice to the real estate gods could all win some favor and award you chances to waive fees or get a better deal.

Typical things that could be offered by the seller are help towards paying closing costs or paying closing costs entirely.

Random Additional Costs

Now a big laundry list of other costs you could have to pay for:

- Appliances

- Fridge

- Washer/Dryer

- Furniture

- New home blinds/curtains

- Couches

- Closing costs

- Inspection

- Putting in a lawn

- HOA

- Insurance

- PMI

- Home insurance

In summary:

- interest rates are a big deal

- you can play around with amortization schedules to see how much you’d pay monthly and where you could save

- getting a house is a great investment in some lights, but not in others (but at least you get to use the investment! you can’t raise kids in a stock portfolio)

4. Due Diligence

Once you’ve made an offer and it’s been accepted, you’ll need to do some due diligence to make sure you’re not buying a lemon.

Inspections

You don’t have to, but it’s a good idea to get a home inspection. This is a third party that will come and look at the house and tell you what’s wrong with it. They’ll look at the roof, the foundation, the furnace, the water heater, the plumbing, the electrical, and everything else. They’ll give you a report of what they find, and you can use that to negotiate with the seller to fix things or lower the price.

We paid a little under $500 for an inspection, so hopefully we save that money in the long run from the stuff we found.

Even if you don’t get an inspection, you should still take some time to look over everything you can find in the house and point out any problems before you close. This is the only time you’ll have leverage to get the seller to fix things.

5. Moving In

Once you’ve closed on the house, you’ll get the keys and you can move in, then more fun of home ownership begins!

Getting Appliances + Furniture

There are a lot of appliances you need if you are buying a new home. If you are buying a used home, you may replace or need to service some of those appliances. Buying new can require some time for delivery, so be aware of that when planning when you’ll move.

Here’s some stuff we learned about the stuff we had to get:

Kitchen Appliances

- Fridge: the things that make one fridge different than the next:

| Feature | Good | Bad |

|---|---|---|

| Ice maker | You can get ice from the door | Costly. Takes up space in the fridge/freezer |

| Water dispenser | You can get water from the door | Costly. Takes up space in the fridge/freezer |

| French doors + Bottom Freezer | You can open the fridge from the middle, fit bigger things in the freezer with large baskets | More expensive. Takes up space in the fridge/freezer |

| Side by side doors | More small storage compartments in the freezer, ice maker can be more efficient since it’s closer to the freezer | Can’t fit some big things like a turkey in the freezer |

We got a side by side door with ice maker and water dispenser.

- Oven + Stove: the things that make one oven different than the next:

| Feature | Good | Bad |

|---|---|---|

| Gas | Heats up faster, more precise temperature control, cheaper to run (ie gas is cheaper than the electricity required to heat food) | More expensive overall |

| Electric | More expensive to run (ie electricity is more expensive than gas), less precise temperature control, takes longer to heat up | Cheaper overall, harder to clean |

Cooking aficionados probably prefer the gas stove in most cases.

We got a gas stove.

- Dishwasher: I can’t tell you what makes one better than the next, honestly. I’m sure there are differences but I don’t notice them.

We got some generic GE dishwasher.

- Microwave: Ditto on microwaves.

We got a GE microwave.

Laundry Appliances

- Washer: the things that make one washer different than the next:

| Feature | Good | Bad |

|---|---|---|

| Front load | Allegedly washes better?.. can stack with a dryer if space is tight | More expensive, sometimes need to buy a little step stool thing underneath it, keeps moisture inside which is kind of gross |

| Top load | Cheaper, can’t stack with a dryer, can leave it open to ventilate after wash cycle | Allegedly doesn’t wash as well?.. (citation needed) |

| No Agitator | More space for clothes, less wear and tear on clothes (especially delicate clothes) | Allegedly doesn’t move clothes around as well without one |

| Agitator | Allegedly moves clothes around better with one | Less space for clothes like big bed sheets, can rip or tear delicate clothes if you aren’t careful |

We got an LG top load with no agitator.

- Dryer: the things that make one dryer different than the next aren’t much, it’s basically the size of the drum which determines how much clothing you can dry at once. The bigger the drum, the higher the cost.

We got a bigger sized LG dryer.

Furniture

- Couches: the things that make one couch different than the next:

| Feature | Good | Bad |

|---|---|---|

| Leather | Easy to clean, looks nice | Expensive, can get hot in the summer, can get cold in the winter, wears and tears faster over time from use |

| Fabric | Cheaper, doesn’t get hot or cold, doesn’t wear and tear as fast | Harder to clean if stained |

| Sectional | Can fit more people, can rearrange pieces to fit different spaces, easier than some big couches to move in pieces | Usually more expensive |

We got a fabric sectional couch from Ashley Furniture. They pushed back the delivery time on us a couple times, which meant we were living without a couch for a while.

- Mattress: the things that make one mattress different than the next:

| Feature | Good | Bad |

|---|---|---|

| King Size | More space for you and your spouse, wider | More expensive, a pain to move |

| California King Size | Like King Size but taller, not wider | More expensive, a pain to move |

| Queen Size | Cheaper, easier to move | Less space to sleep on |

We got a King Size mattress, it’s a pain to move, but it’s nice to have extra space so we wake each other up less.

- Dining Table: the things that make one dining table different than the next:

| Feature | Good | Bad |

|---|---|---|

| Wood | Looks nice, can be refinished if damaged | Pricey, heavy |

| Extendable | Can fit more people, can shrink or expand to accomodate different sizes | Cost, need to store extra pieces if they don’t fold under the table somewhere |

We’re planning on getting an extendable table and haven’t quite decided on the finish or style yet.

Weird Sounds and Tips

Depending on what type of systems you have for heating and cooling, you might hear some weird sounds that no one told you about. Sometimes these are indicative of actual problems, sometimes they’re just normal. You won’t really know which is which until you do a lot of searching the internet and talking to other homeowners.

In our experience, the biggest culprits of weird sounds were:

- our new refrigerator which would occasionally make chugging sounds, and would also drop ice into an ice tray that is a bit loud

- our furnace would make a bang sound that echoed through the air ducts when it kicks on, and again but not as loud when it turns back off

- draining lots of water from a bathtub or running the washing machine, which you can usually hear in the pipes that run along the sides of the house

Best of luck! And may you burn money on someone else’s mortgage no longer! 😉